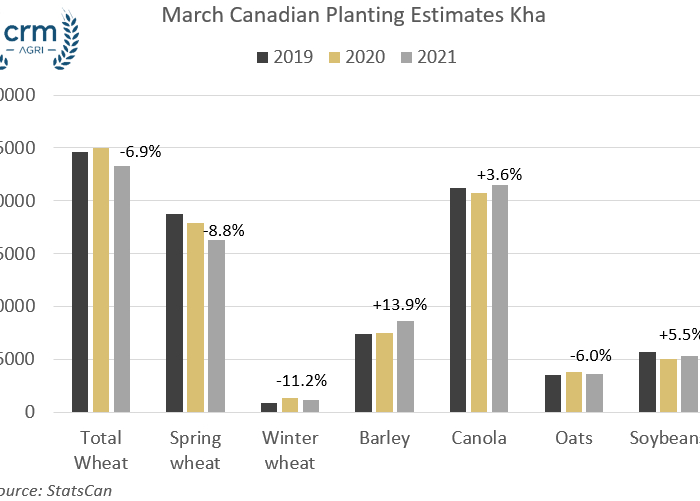

Canadian Planting: Grain down, Oilseeds up

In the midst of a spring weather market, market attention is fully focused on the prospects for spring crops.

Reduced crop potential for next season

Reduced availability in France has pushed new crop oilseed rape markets to record pre-harvest levels. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Potential supply reduces

For the heat to come out of the corn market, regular rainfall will be needed in Brazil, which as time passes, becomes less likely. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Increasing Moisture Deficit

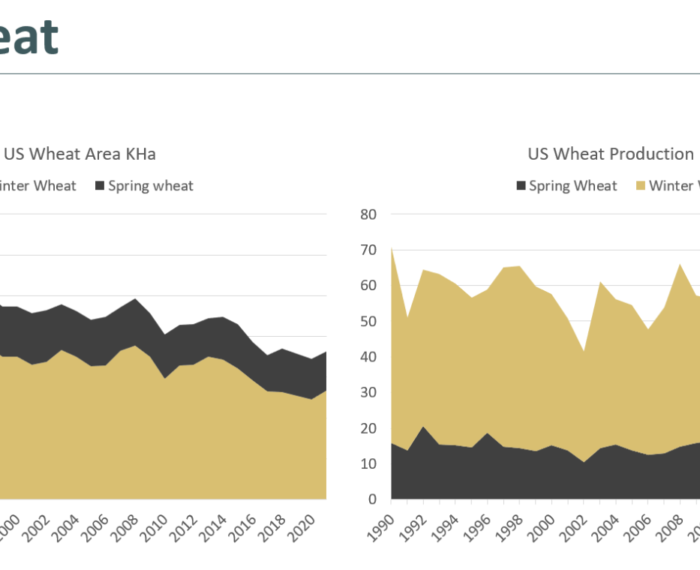

In this spring growing period, it’s all about the weather. There has now been a sustained push higher in both old and new crop wheat markets, as unfavourable spring weather dominates headlines. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Spring Weather Markets – Rumour or Fact?

We are currently in the middle of a strong spring weather market, with increased volatility due to current season tight markets. Although there is plenty of time for spring crops to get planted and needed rainfall to arrive, markets are already pricing in the potential for crop loss. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Cold Spell Support

Oilseed rape markets have continued to receive support, but as the focus moves to harvest ’21, the attention has been on the potential additional crop loss in France from the recent cold spell and the continued dryness in Canada. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Safrina Rainfall Concern

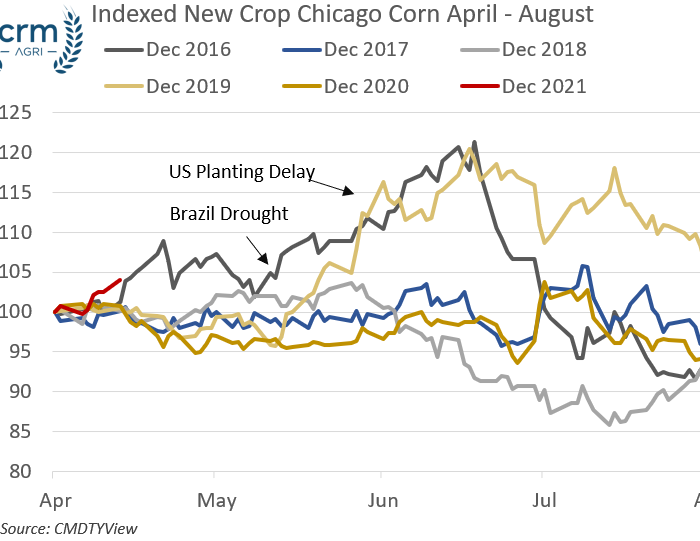

Global corn markets have continued to receive support. Like with wheat, corn markets are reacting to the weather, and the knock-on implications for production in Brazil and the following US corn crop. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Insufficient US Moisture

Across all commodities, the drivers are the weather and the prospects for wheat, corn and oilseed harvests later this year. As dry weather continues to dominate the northern hemisphere, new crop markets are gaining support. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Corn Market Risks – US and Brazilian Corn

Although the 2020/21 season still has a while to go, and has been characterised by unprecedented Chinese corn demand, the focus has now shifted to Brazilian corn production and the 2021 US harvest prospects. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Large Australian canola imports enter the EU

So far 5.253MT of rapeseed imports have entered the EU, the fasted pace on record Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Risks remain in Brazil and the US

Corn markets are still fully focused on the prospects for next season. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Wheat not out of the woods yet

The week-on-week continued fall in global wheat markets came to an abrupt end, with Chicago, Paris, and UK wheat futures all bucking the recent downward trend Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe