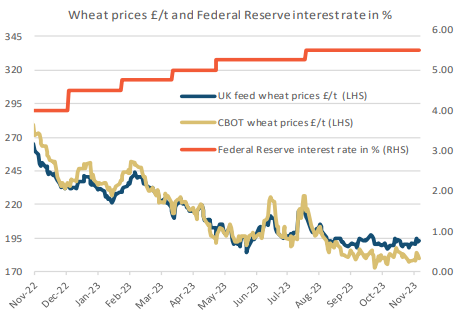

• Global economic growth cools down slightly • Markets price in three US interest rate cuts before year-end • Chinese import demand raises concerns Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Funds slash short positions in grains, chances of interest rate cuts increase. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

In this report, we focus on the recent escalation of the conflict in the Middle East and the implications for grains and wider commodities and trade. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

In this report, we focus on the recent escalation of the conflict in the Middle East and the implications for grains and wider commodities and trade. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

In this report, we focus on the extremely large short position money managers have amassed in grain and oilseed markets. We look to understand whether the net short position built up since mid-2023 by non-commercial traders is sustainable or if a reversal is coming, Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Markets are currently pricing in the first rate cut to come in May or June, which is much later than last month when markets priced in a March rate cut by the Fed with 70% certainty. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

CRB index sinks on weak crude oil prices Dry bulk shipping costs declines after its December rally on better prospects for the Panama Canal US dollar finds some support in early January after falling sharply in December Global interest rate cutting cycle called into question due to rising US inflation Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

What to watch in 2024 for corn, wheat and barley markets Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

2023 was a year of ongoing volatility and significant moves in grain markets, this report look back at what drove prices, our forecasts, and what surprised us, as well as ahead to 2024 and what we expect. – 2023 Market Review – Looking ahead to 2024 – Reflecting on our 2023 forecasts (wheat, corn, soybeans & rapeseed) – Surprises along the way Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

The Baltic Dry Index reached the highest level since June 2022, due to strong demand for base metals and grains. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

As the world’s largest commodity buyer, China’s economy plays a pivotal role in determining the future direction of agricultural prices. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Latest conflict in the Middle East could push crude oil prices above $100/Bbl before the end of the year, boding well for grain markets. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe