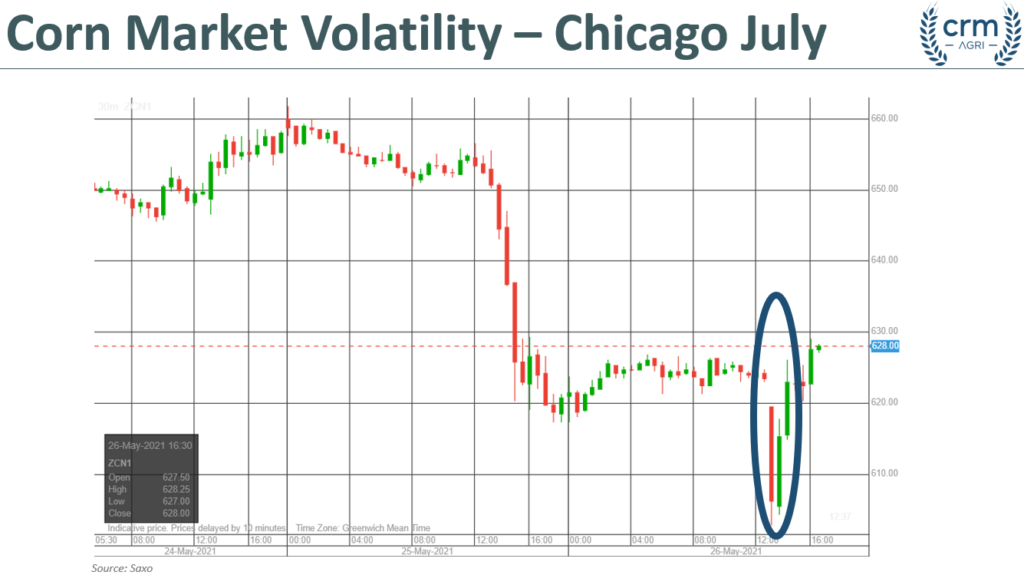

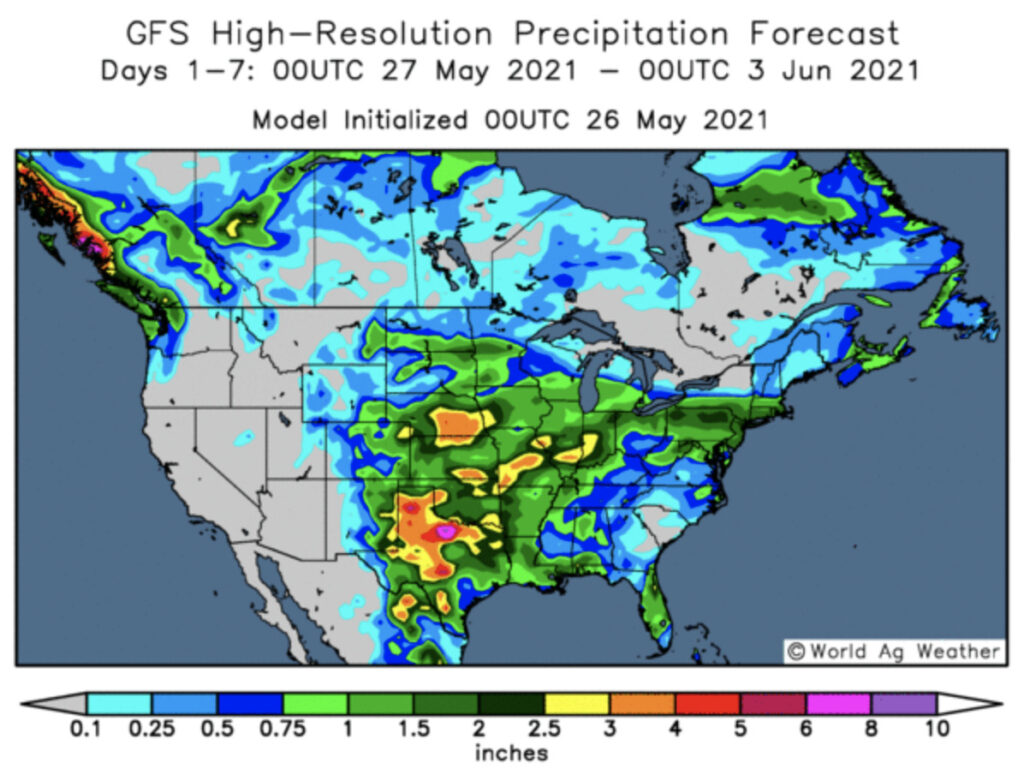

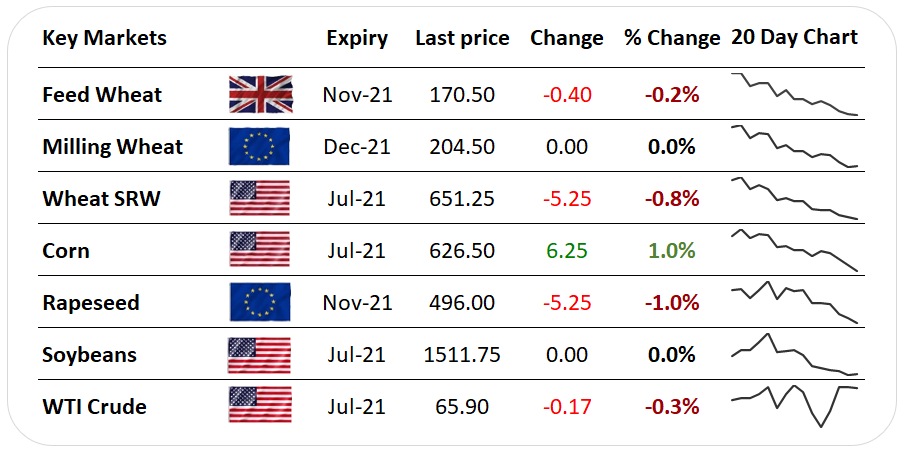

EU Rapeseed values have lost over €60/t over the past two weeks following global vegetable oil prices lower despite supported crude oil values. Global grain markets came under pressure again today amid concern and speculation about statements made by China about their corn demand. Risks still need considering as covered in the latest weekly insights and opinions. Media reports that China is going to restrict imports of US corn into ‘free trade zones‘ for blending into animal feed before importing free of tariffs or quotas led to a fast sell-off in Chicago corn markets. There are reports of cancelled vessels from feed mills to China, but official and reliable data on the scale of cancellations might have to wait until later this week when official export sales data is released. Should there be a meaningful cancellation of export sales to China then the US balance sheet will look less tight. However, current US-China sales remain substantial and markets are cautious to take political statements as gospel or a reflection of actual intentions. Why does this matter? China has been a large driver behind the 2021 rally in corn prices, making sustained and substantial purchases of US corn for not only the 2020/21 but also the 2021/22 season. Emerging as a key driver behind grain markets, estimates for the Chinese corn and wheat demand have become an increasingly significant driver behind global grain prices. |