Fertiliser spot price averages stayed on their downward trajectory since the start of the year, predominately driven by replenished global supplies and lower natural gas prices… Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GGO provides a longer term, opinion based outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Climate change poses a risk to more volatile yields, while also driving demand for biofuels, providing long term support for global grain prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GGO provides a longer term, opinion based outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

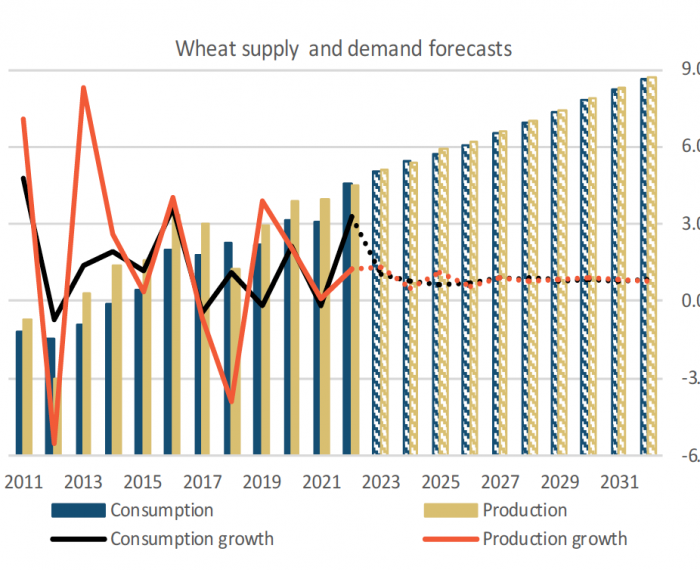

Global consumption of wheat, corn and soybeans still expected to rise, but at a slower pace over the next decade than the previous decade. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

As harvest gathers pace and following the release of the July USDA report, this short video for clients covers: – Global economic drivers – USDA data – Global supply & demand – Oilseeds & veg oils Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GGO provides a longer term, opinion based outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Combined speculative short positions in grains started to unwind in early June, but remain at elevated levels. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Forecasts highlight natural gas prices jumping over the next year with more upside than downside priced into the market. Higher gas prices will keep fertiliser markets—particularly in Europe—tight over the next couple of years. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GGO provide a longer term outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

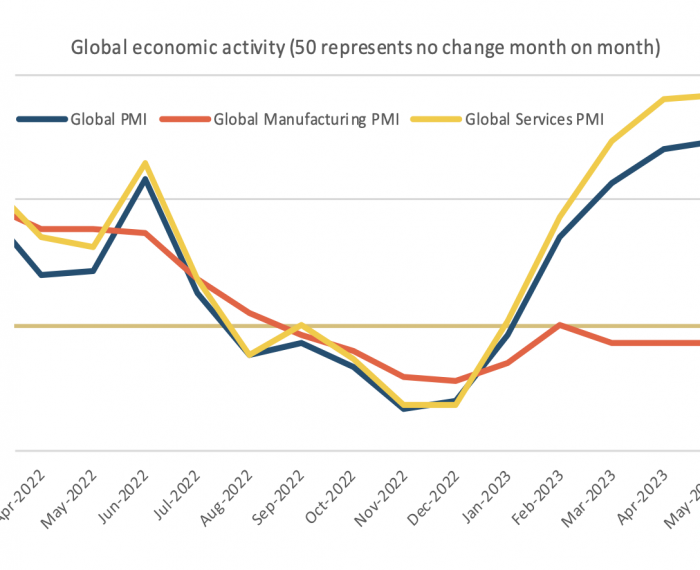

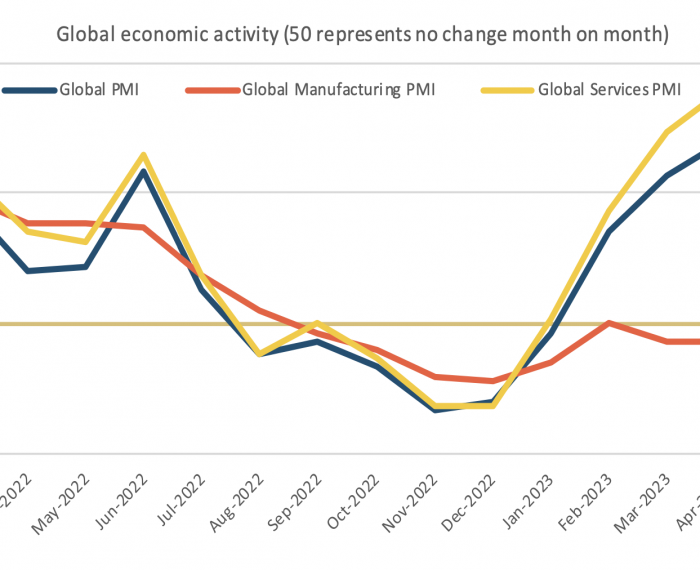

Global economic output expanded at the quickest pace since December 2021 in April. Global grain prices are on track to average notably lower this year relative to 2022, but upside risks could emerge in H2 2023. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

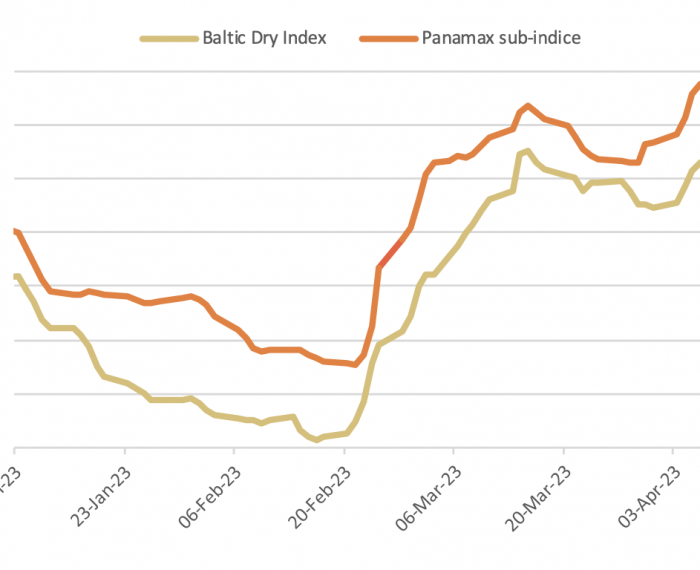

Global supply chain pressures lingered over the past month, with the cost of dry bulk shipping increasing notably. Combined speculative positions in agricultural commodities remain in a net long position, but there remains a large net short position in wheat. Global supply chain pressures lingered over the past month, with the cost of dry bulk shipping increasing notably. Global grain prices will average lower in 2023, but plenty of upside risks remain, particularly due to volatility in energy markets amid still-strong demand. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe