Russian Markets Likely To Become Increasingly Opaque

Find out about subscriptions Russian Markets Likely To Become Increasingly Opaque

Weekly Oilseed Outlook

Rapeseed: Rapeseed prices have staged a recovery, after last week falling to their lowest since July 2021.Rapeseed’s price upturn tallied with revivals in many markets, as concerns receded over the bank sector tremors stemming from Silicon Valley Bank’s collapse, and UBS’s takeover of Credit Suisse. Signally, crude oil futures, an important influence on prices of crops such as rapeseed used largely in making biofuels, bounced from their lowest levels since late 2021 as worries over economic fallout faded. Soybeans: Having fallen back down to October lows earlier this month, May-23 US soybean futures have been recording a partial recovery. The bounce in crude oil is providing a floor to oilseed markets, and despite the arrival of the Brazilian soybean harvest, bearish downward pressure is reducing. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Weekly Grain Outlook

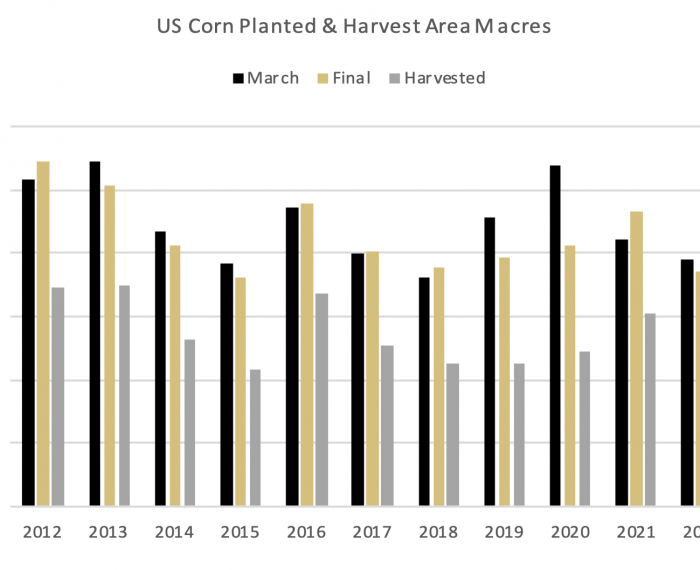

Wheat: Black Sea support has returned as rhetoric surrounding rumoured export bans from Russia, and increased export taxes… Barley: EU barley markets were supported by dwindling supplies of Ukrainian barley… Corn: Corn markets have found support, helping underpin grain markets as China continues to purchase large volumes… Weather: In North America, the Midwest will receive further rains, as farmers prepare for planting… Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Weekly Oilseed Outlook

Rapeseed: While the pace of EU imports has slowed this month, they remain on course to set a record high above 6.5Mt for the full 2022-23… Soybeans: After what has been a sustained period of support for soybean prices, which remained buoyant while grains came under pressure… Oil & Meal: Vegetable oil values have continued to come under pressure, undermined by the broader economic pressures… Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Webinar: Where next for grain & oilseeds markets?

As markets trade sharply lower and following the renewal of the grain corridor, nervousness in financial markets and continued interest rate hikes, we look at what it means for grain and oilseed markets, as well as look ahead to the 2023 crop conditions. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Weekly Grain Outlook

Current market overview and short term outlook for wheat & corn. – Wheat – Barley – Corn – Weather Alerts Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

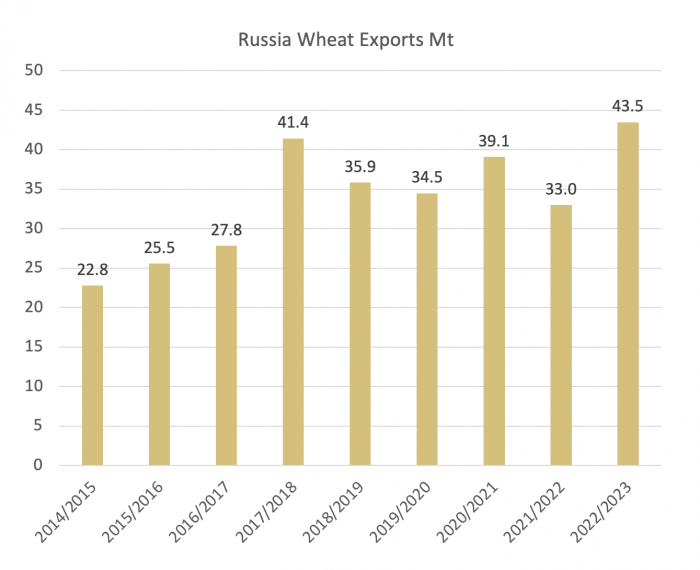

Highlight Article: Black Sea Exports & Production

The grain corridor agreement which expired over the weekend has reportedly been extended, although the details of the terms remain shrouded in ambiguity. Both sides are making different statements with Russia suggesting a 60 day extensions and Ukraine and Turkey stating another 120 days has been added to the agreement. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Global Agricultural Economic Outlook – March 2023

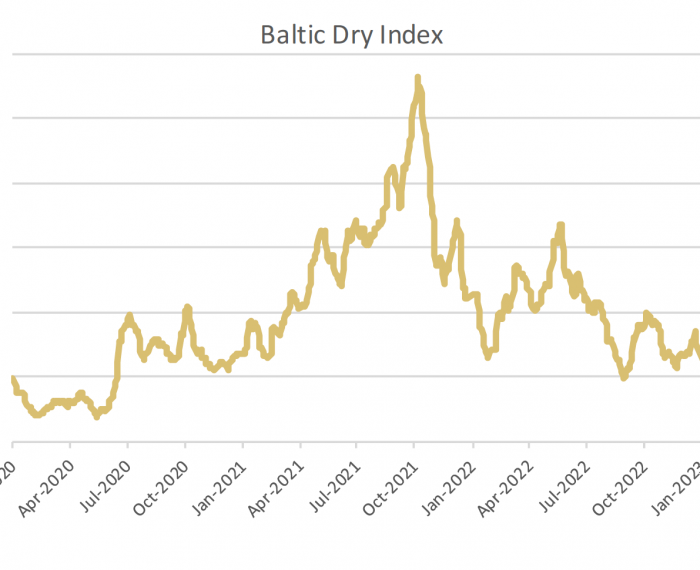

Overall, the global economic backdrop has showed numerous signs of improvement over the past month, supporting the outlook for the demand for agricultural goods. That said, given inflation is still too high in most developed economies, this strong macroeconomic environment allows major central banks some leeway to hike interest rates further this year, which is a headwind for agricultural demand ahead and capping price movements higher. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

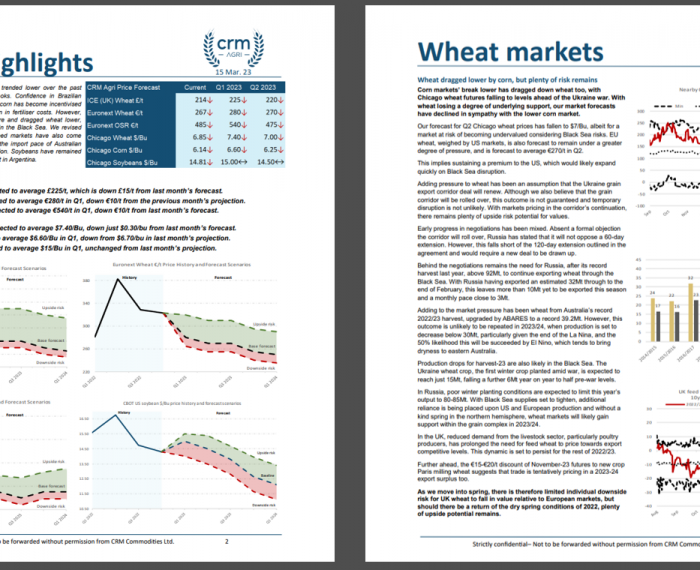

March Global Grain Outlook

GGO compliments our weekly insights, providing monthly longer-term analysis, S&D and price forecasts of global markets and prices covering the grains and oilseeds. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Grain Traders Bank On Renewal of Vital Ukraine Crop Deal

Find out about subscriptions