Near record US soybean plantings expected

The overall oilseed market is lacking a clear direction as bullish and bearish factors outweigh each other. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

US corn plantings underway

The unescapable news of last week was the exceptionally large US-China export sales, this brings total US exports and sales to remarkably high levels for this early in the season… Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Crop conditions go from strength to strength

Wheat markets have continued in the bearish tone, reversing the gains made in Q1 of 2021. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

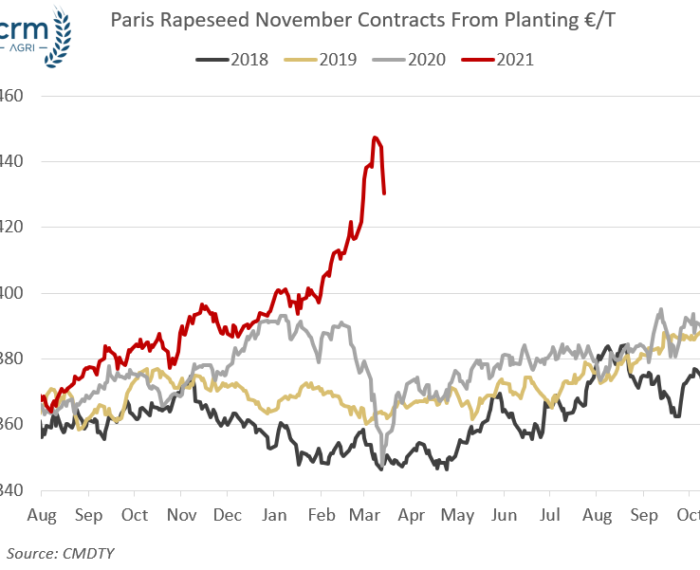

Rapeseed under pressure, risks remain

Soybean markets have continued to trade sideways as the bullish factors of tight US stocks continue to be balanced with increasing availability from Brazil. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Risks remain for Brazil second corn crop

Corn markets have been dominated by the large US-China export sales. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Improving prospects for Black Sea wheat

Wheat markets have continued their recent downward trend as current season supplies remain sufficient and northern hemisphere growing conditions remain positive. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Oilseed Rape Risks and Rewards

Looking to next season, with reducing areas in the UK, Ukraine, and likely the EU, oilseed rape supply next season will be even more reliant upon a benign spring, and an average to on-trend increase in yield to maintain supply. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Oilseeds Market Update – March 2021

In this video, James Bolesworth and Peter Collier look back at 2020 and focus on the main factors to consider as we approach the 2021 harvest. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Cereals Market Update – March 2021

In this video, James Bolesworth and Peter Collier look back at 2020 and focus on the main factors to consider as we approach the 2021 harvest. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GBP strength continues on vaccine rollout

Sterling recovers on stronger economic outlook.. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Oilseeds – Weekly

Soy markets, like corn, are caught between the opposing market forces of tight US markets, against larger South American supplies and projections for easing global supply into 2021/22. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Corn – Weekly

Global corn markets are perhaps the market which is most conflicted, split between tight Northern Hemisphere supply and the outlook for tight supplies to ease over the next 6 months. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe